You'll know the very second when a check clears or when a bill is paid, so you're never confused about where you stand financially. You can get text alerts for when your balance dips below a certain limit, or when you face a possible overdraft charge. If you really want to stay on top of every dollar that goes in and out, you can use online banking apps to set up text alerts for when transactions post. (See also: These 5 Apps Will Help You Finally Organize Your Money) 3. Other apps like Clarity Money and Wally will also help you track spending money so you know precisely what's going in and out at any given time. Many of them also allow you to deposit checks by sharing an image. If you have online banking, most banks also offer smartphone apps with the same functionality as their websites. (See also: 5 Best Online Savings Accounts) 2. There's no waiting around for monthly statements you can look immediately to see if a transaction cleared, and you'll notice any errors immediately. It's easy to check balances, transfer funds, and pay bills.

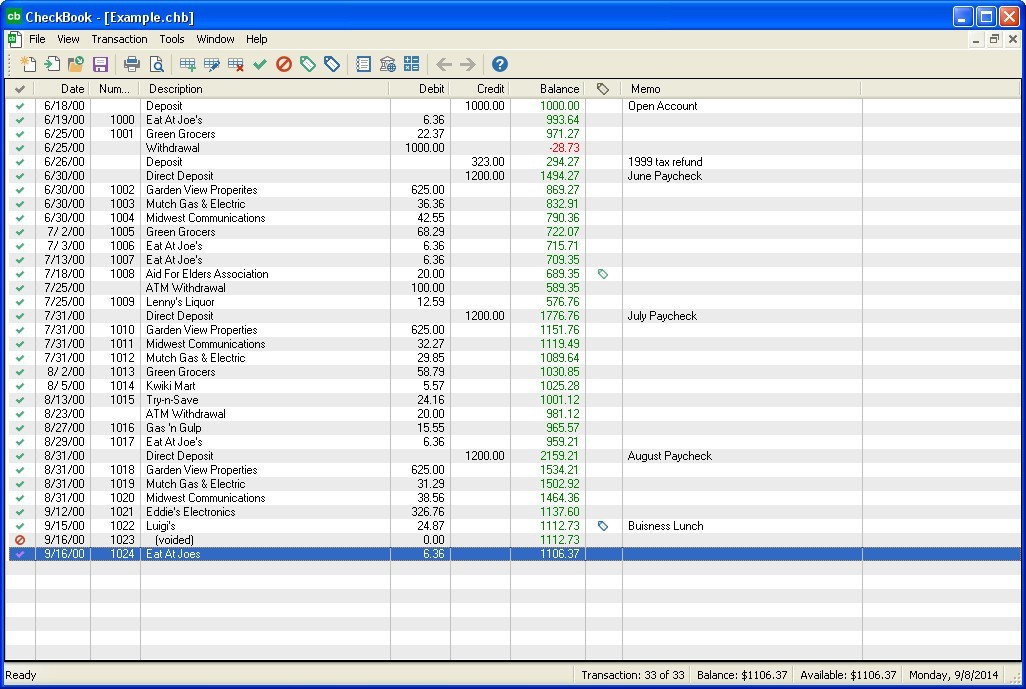

Online banking gives you a real-time look at your money, so you know if payments and deposits are processed correctly. In fact, many modern banks don't have physical branches at all. These days, every bank encourages you to sign up for their online banking service. So how do we do it? Check out these ways to balance your checkbook in the modern age. It's still necessary to make sure you're tracking withdrawals and deposits and staying on top of your checking account balance. But these days, balancing your checkbook manually isn't nearly as essential due to advancements in technology and changes to our financial habits. It's akin to how some people still listen to compact discs or carry around flip phones. It was time to balance the checkbook - an essential task for any family looking to accurately track spending, avoid overdrafts, and stay on budget.īalancing your checkbook is still practiced in some circles. I remember watching my mom sit at the kitchen table at the end of each month, examining a checkbook ledger and paper statement from the bank.

0 kommentar(er)

0 kommentar(er)